The art market highlights the problems with a decentralized world. It may ultimately mean that there is no one entity that dominates the scene, but principles of trust and community will result in awesome art creations.

There’s an allure to a decentralized world where the big tech companies no longer hold the power, where middlemen are shuffled off to oblivion, and where creators speak directly to their loyal communities. Utopian dreams are healthy parts of any economy. But they rarely turn out to be very realistic. Nowhere is the disconnect between the staid world of traditional power and the new world of tech savvy players starker than in the art world.

Digital art has been around for a long time, but because it could be freely copied and distributed with little oversight over ownership and rights, it was a tough way for starving artists to eke out a living. With the introduction of NFTs, and smart contracts that represent ownership, the art world figured it stumbled on the missing key, a way to use the medium to let artists sell their wares on the blockchain using cryptocurrency. The promise? Reach more audiences, encode rights and special offerings inside the NFT, and have irrefutable proof of ownership. (As a matter of fact, some artists are coding ongoing royalty payments into their works so that they get a piece of the action each time their art is bought, sold, or traded.

For a moment it looked like a renaissance. Cryptopunks and NFTs like it launched in 2017, but the penultimate NFT years were 2020 and 2021. Depending on whose research you believe, the NFT marketplace quickly caught up and nearly outpaced the growth of the traditional art market. According to a report published by non-fungible.com, NFT sales made up 16% of the Global Art Market by value in 2021 and early 2022. $2.8 billion was spent on crypto art in 2021, compared to $14.6 billion on traditional art. Business Insider suggests even more bullish data with the market for NFT art surging to $41 billion in 2021, nearly outpacing the conventional art market.

Art Basel 2021: Tipping Point or Denounment

Beeple (aka Mike Winklemann) sold a piece of digital artwork through Christie’s auction house for $69 million dollars. This catapulted him into the rarified air of artists like David Hockney in terms of the value of his work. Unlike Hockney’s work, the Beeples sale, auction, artwork, and currency (crypto) were all entirely virtual, a first for the art community. Since that auspicious moment, five artists have made over $2.5 million selling digital art.

Art Basel 2021 transformed the world of high-end digital art into serious business. Techno bros showing off their NFT-laden mobile phones, standing shoulder to shoulder with high-end art collectors, showing their Cryptopunks and Bored Apes (generated algorithmically) as seriously as the most painstaking paintbrush painting. According to the 2022 Art Basel and UBS Global Art Market Report, written by the cultural economist and founder of Arts Economics, Dr. Clare McAndrew, “a market that was traditionally slow to adopt digital strategies saw online sales account for fully a fifth of sales.” The dyke opened. Crypto art investments spewed forth.

All-In

New art marketplaces like OpenSea and Rarible emerged, seemingly overnight to serve as a gathering place for art NFT. At the same time venerable art houses like Sotheby’s and Christies, both born in the 1700’s went full hog, creating NFT galleries, and playing with the “phygital” NFTs that sold both virtual and IRL art, and more.

Lack of Curation

The NFT party isn’t over, but it’s certainly got quite the hangover.

By anyone’s count, the activity is coming close to flat-lining. Bloomberg reports that this month’s sales have plunged below the $1 billion mark and that the JPG NFT Index is down by about 70% since its April launch.

There are several good reasons behind the NFT stall. Crypto values have plunged and the NFT market is based on crypto. News of scams, frauds and litigation are nearly daily occurrences. Celebrities from Lady Gaga to the Kardashians to Tom Brady overvalued their worth, and anyone who could use MS Paint was suddenly an artist. Plus, there’s that niggling question of how art is displayed. If you can only show your art on your phone or your social media it’s not a particularly satisfying experience.

Who’s the Tastemaker?

But the biggest obstacle is the lack of curation. When you’ve got a VanGogh next to a Weird Whale, all listed in an indecipherable mashup without any storytelling that gives the artwork a context you have a bloody mess. When OpenSea and Rarible (there are many others, too) make the Apple App Store seems well-curated, you have a problem.

The Curation Cure

With the mess of scams, complicated fees, a confounding mixture of algorithmically generated art, cryptocurrency fluctuations, and a lack of “display” realty, the digital art industry needs to mature, which means it’s going to copy some of the most successful techniques of the past

Jonathan Delachaux is the creative director for ArtMeta. “Artists”, he says, “don’t know how to make NFTs. Private collectors don’t know how to tokenize or sell their coveted fine art. Galleries, collectors, and secondary market participants want to get a foot into a growing $25 billion market and digital communities. Collectors and investors want to buy relevant art through a trusted source, using cryptocurrencies as payment.” Deschaux saw an opening to separate highly curated fine art from that you typically might find on a collector’s wall from OpenSea or Rarible collections.

Chris Cummings, CEO of Iconic Moments is passionate about cultural preservation. “So much of our collective heritage is stuck inside of vaults somewhere,” he says. “What’s the point of preserving something if no one gets to experience it?” he asks. Cummings is now working with 150 museums in 14 counties to explore how they can use Web 3.0 to bring the skeletons out of the closet.

“Libraries, museums, and big corporations all have rich histories that they want to share”, says Cummings. Iconic Moments provides a “global passport to culture” and the metaverse provides the perfect vehicle. An attendees’ journey begins with the Iconic Mint Pass — an NFT membership that includes guaranteed access to NFT drops, tickets to special cultural events, and other collaborations. “99% of NFT projects are unsuccessful because they don’t engage their community”, he says. “The 45 million NFTs available on places like OpenSea will get lost without curation.”

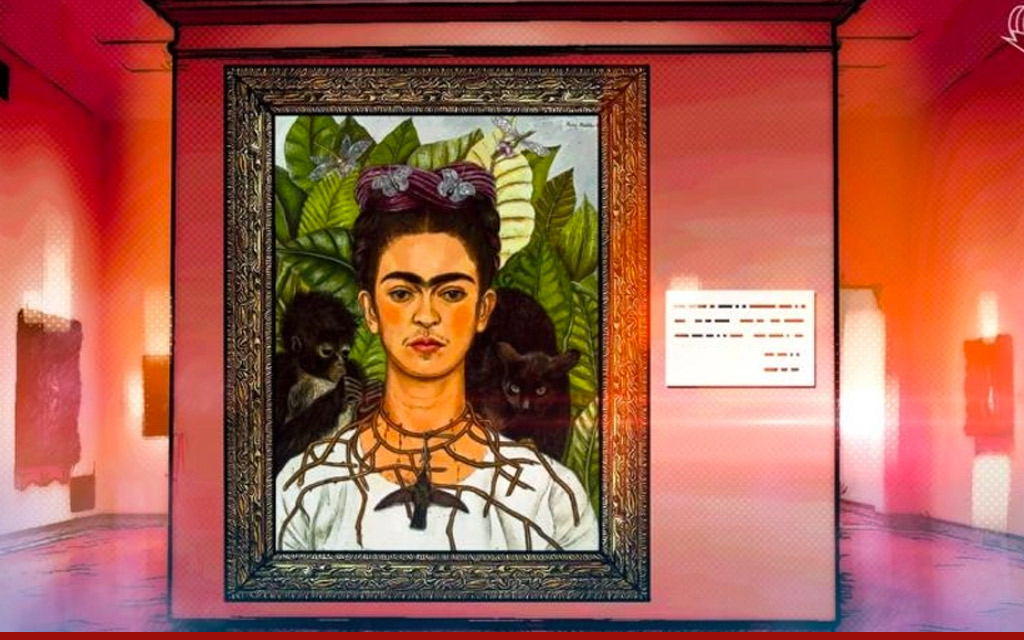

Those two examples just scratch the surface. In Decentraland in late August the Frida Kahlo Family and Eziel opened the Red House to make Kahlo’s work accessible to a new generation of digital natives. Art NFTS are also being imbued with special coded superpowers so that the artist can, for example, receive royalties anytime their work is sold, in perpetuity.

Decentralization may ultimately mean that there is no one entity that dominates the art scene, but traditional, often centralized, principles of trust and community will result in awesome art creations.