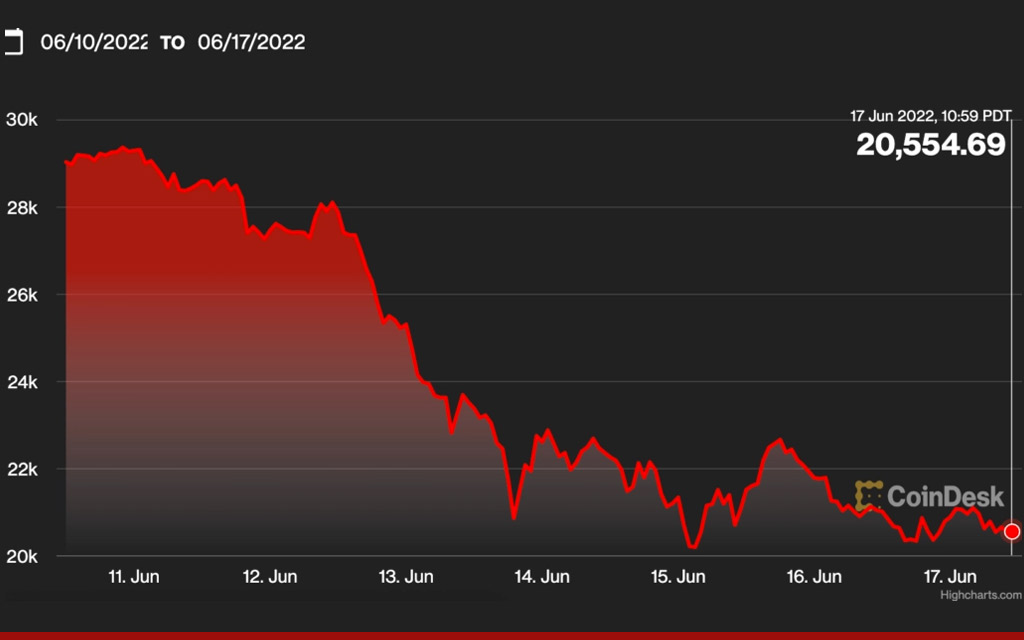

Despite daily reports of bad news about cryptocurrencies, the true believers at Consensus in mid June remained optimistic. Community leaders share why that was.

Despite daily reports of bad news about cryptocurrencies, the true believers at Consensus in mid June remained optimistic. I asked a few thought leaders in the community why that was.

Lucia Gallardo, Founder of Emerge, a company that is dedicated to developing tech solutions with social impact, sent me an email about the mood at Consensus. “It is…one of the most reputable conferences in the space, and it also saw the 2017/2018 winter cycle. Those who made the effort to go to Austin this year were there because they firmly believe in the technology and where it is heading with a longer-term vision. We have an inside joke across the space which says ‘bear markets are for builders’. People are excited about the projects that are holding firm, that are creating long-term value, that are building trust, and that was the true mood at Consensus. The mood at Consensus is optimistic because the content is curated to focus on vision-centric builders, and short-term dynamics are less dominant in their attitude toward what is a much grander picture. Additionally, as we see the traditional financial market perform poorly and inflation rise to historic amounts, it becomes harder to trust traditional financiers.”

I asked Louis LaValle, managing director of the NY based digital asset firm 3IQ, what part the growing number of institutional investors are playing in the current roller-coaster crypto market. In reply he wrote: “Institutional investors are having a greater impact on the digital asset landscape today than ever before. We now have greater infrastructure to support more digital asset onramps, so naturally there’s a stronger link today between traditional capital market events and crypto price action. But we believe that price and fundamentals are two separate conversations. Right now, prices are largely being driven by global macro events, and partly by events unique to the broader digital asset ecosystem. And while price depreciation is painful, we believe it’s temporary. There’s nothing in our analysis that shows the long-term thesis for owning Bitcoin, Ethereum and other digital assets is broken.” He continues, arguing that, “by design, the fundamentals of Bitcoin and Ethereum, for example, continue to get stronger and stronger especially when comparing those fundamentals to traditional risk assets”, and they are programmed to be disinflationary over time because there’s a fixed supply, unlike fiat currencies.

———