Peter Fusaro, Founder of Wall Street Green

A passionate talent pool, regulation, and a shift from education to implementation by businesses make 2023 the perfect moment to make our greenest dreams come true. Even Wall Street, where green is more likely to be equated with the color of money than trees, is paying close attention.

The tech industry’s ubiquitous layoffs have left a lot of talent searching for their next gig. Many of them are talking openly about pursuing jobs with more purpose. A recent LinkedIn news story talked about climate-focused jobs as a “landing pad” where many newly laid-off tech workers might show up. Last year the clean energy sector raised almost $20 billion and attracted a lot of new talent, according to this New York Times report.

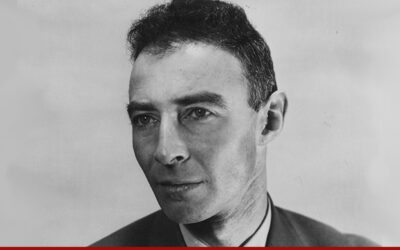

While aspiring techies are leaning green, others have already devoted a lifetime to laying the groundwork for the greening of Wall Street. For the past 32 years (way before it was fashionable), Peter Fusaro’s passion has been to bring Wall Street closer to Green street. He created The Wall Street Green Summit, the longest-running sustainable finance event in the industry. Its mission is to build a sustainable financial system for responsible investing. He also consults on carbon markets and ESG investing and wrote a best-selling book about Enron’s calamitous implosion in the early 2000s.

When Wall Street sees green, it acts green

“Investors are ready, corporations are ready, and the marketplace is ready to act,” said an enthusiastic Fusaro when I interviewed him in my Manhattan home in early February. “My phone is ringing off the hook with companies that all have the same questions: ‘What is ESG and why are carbon markets so important?’ They are ready.”

Fusaro notes that anytime there’s a great revolution in energy, say from coal to gas, to electricity, there’s ramp-up time. But this is an inflection point. “Look at the Security and Exchange Commission’s (SEC) recently proposed rules on Climate Disclosure,” he says. “They will put climate risk on a company’s balance sheet, and that’s a big deal.”

Theoretically by this April, the SEC will require U.S. public companies to file climate risk and greenhouse gas emissions data along with other filings. Though this week, the SEC waffled a bit in response to a shaky economy and pushback from executives and their boards.

While the SEC is focused on reporting, the Commodity Futures Trading Commission (CFTC) voted to release a Request for Information (RFI) to better understand the public’s stance on climate-related financial risk. Hopefully this will promote responsible innovation in the green tech space.

President Biden reinforced the administration’s green theme in his State of the Union address, touting the Inflation Reduction Act’s target of reducing carbon emissions by half from 2005 levels by the end of the decade.

But as with other breakthroughs, progress appears incremental. “Some companies are going to be out ahead of the curve, going beyond reducing emissions in operational efficiencies,” said Fusaro. He believes major oil and gas companies are looking further downstream and shifting from traditional sources of revenue to new and cleaner ones.

At this year’s Wall Street Green Summit, decarbonization is the mega theme. It will be approached through conversations on ESG (with a heavy emphasis on the “E”), data gathering, risk analysis, carbon offsets, clean energy technology, and investing in green tech and AI. Rather than speeches by bureaucrats or academics, Fusaro assembles practitioners who are working on solutions in the trenches. The audience includes investors, family officers, sovereign wealth funders, and others primed to make investments in the sector.

With a new talent pool, new regulations in the offing, and corporate executives and board members paying rapt attention, 2023 could be the year that Wall Street adds another shade of green to its vocabulary.

Source: https://techonomy.com/wall-street-is-finally-ready-to-go-green/